What if you had one platform for all tax-related services from government agencies in India? In a country of over 1.4 billion people, that’s no longer a future possibility. And it’s happening in under 18 months. At the center of this transformation is PAN 2.0. A landmark upgrade to the Permanent Account Number system.

India’s digital revolution is redefining how citizens interact with government systems. Gone are the days of navigating fragmented portals or waiting weeks for paper documents. With innovative features, the common business identifier simplifies how identities are verified with the Income Tax Department.

As media professionals, we have access to verified updates at the tap of a button. Our ongoing interaction with various government agencies in India allows us to bring timely, accurate, and relevant information straight to you.

In this article, you’ll learn everything you need to know about PAN 2.0. We’ll also explore how it fits into the larger story of India’s digital transformation. This digital transformation is creating a ripple effect across banking and the Indian economy. Get ready to understand what it means for you.

Also Read:

- Content Readability & SEO: How Optimization Tools Help

- The Future of Business Management: AI’s Role in Driving Innovation and Growth

Understanding PAN 2.0: India’s New Digital Tax Identity System

India’s identity management for taxpayers is undergoing a major digital transformation. PAN 2.0 is not just a technology upgrade—it’s a foundational shift designed to improve security, transparency, and efficiency for millions of users across India.

A Quick Look at PAN

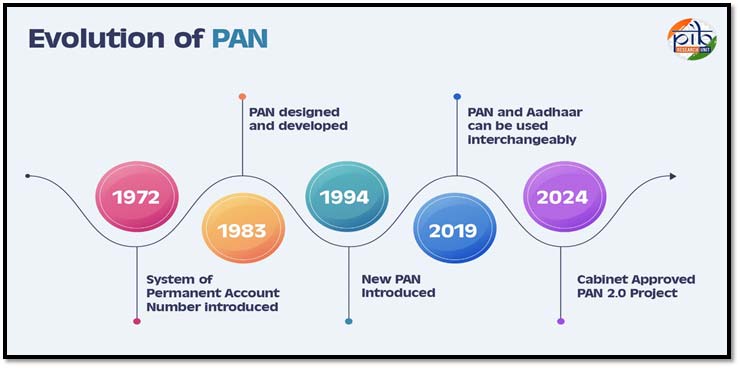

The Permanent Account Number (PAN) has evolved significantly since 1972. Initially created to link financial activities to the Income Tax Department. Statutory under Section 139A of the Income Tax Act, PAN is a 10-digit alphanumeric ID.

The graphic above highlights key milestones—from the system’s design in 1983 to Aadhaar integration in 2019, and now the Cabinet-approved PAN 2.0 project in 2024.

Here’s what you need to know about the latest PAN 2.0 upgrade.

What is PAN 2.0?

PAN 2.0 is the upgraded version of the Permanent Account Number system introduced by the Income Tax Department. The system is being developed by LTIMindtree and is expected to go live within 18 months. PAN 2.0 follows global best practices and meets key ISO standards for data security, quality control, and service reliability, including ISO 27001 and ISO 9001. It marks a major step toward Unified Taxpayer Services in India.

Why PAN 2.0 Matters

PAN 2.0 is more than a tech upgrade. It’s a system-wide reset that strengthens India’s tax infrastructure and simplifies compliance.

- Builds trust through secure, Aadhaar-linked taxpayer identity

- Eliminates duplication by unifying scattered PAN and TAN systems

- Supports India’s vision for digital governance and economic transparency

What’s the Difference between PAN 2.0 and current system?

PAN 2.0 eliminates the need for multiple service portals. It introduces a centralized system that unifies all PAN and TAN-related services under one platform. With faster grievance resolution and enhanced data security, it simplifies how taxpayers interact with the Income Tax Department—making the entire process faster, smarter, and more transparent.

In short, PAN 2.0 is essential to India’s journey toward a seamless, paperless, and Digital PAN India future.

Key Features of PAN 2.0

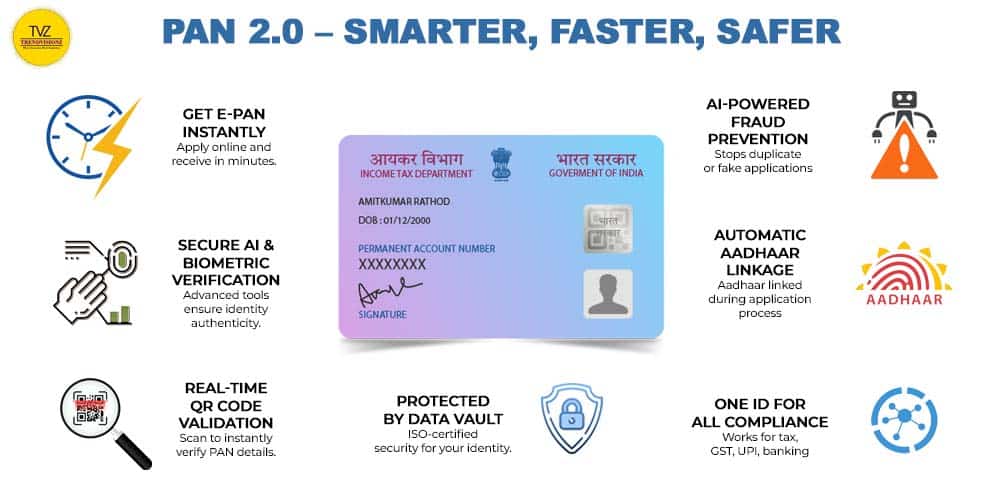

PAN 2.0 is designed to streamline India’s tax identity system through automation, paperless workflows, and secure digital access. As it evolves into a Common Business Identifier, PAN now links individuals and businesses to multiple financial, regulatory, and compliance platforms—seamlessly and securely.

Here’s a closer look at what makes PAN 2.0 a smarter upgrade:

- Instant e-PAN issuance. The e-PAN is issued immediately upon online application and delivered to the registered email, with no paperwork involved.

- AI and biometric authentication. PAN 2.0 integrates advanced AI and biometric tools to verify identity, improving both speed and security.

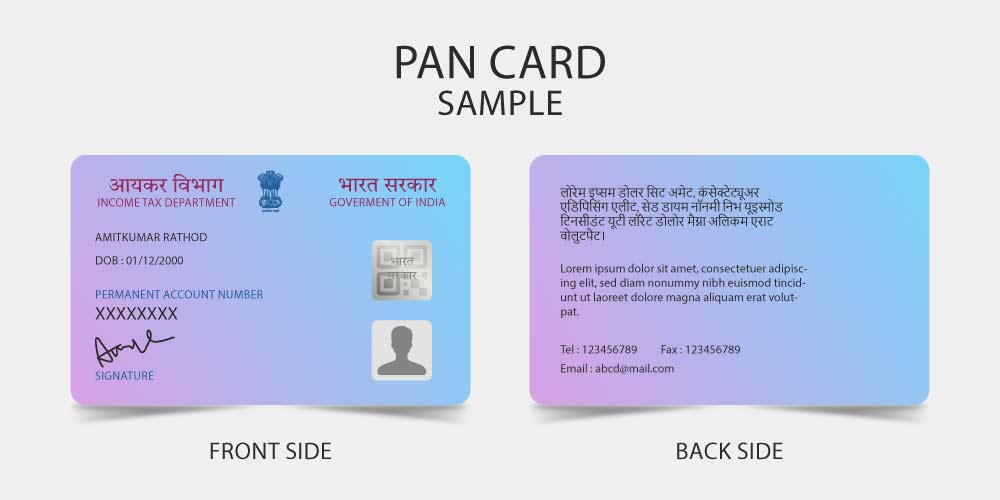

- Dynamic QR code and Data Vault protection. Every new PAN card carries a dynamic QR code for real-time data verification. A secure Data Vault protects user data and meets ISO 27001 and ISO 9001 standards.

- AI-driven fraud detection. The upgraded system actively monitors applications for suspicious activity, reducing the risk of identity theft or duplicate PANs.

- Automatic Aadhaar linkage. PAN is seamlessly linked to Aadhaar at the time of application or update, simplifying compliance for both individuals and institutions.

- Ease of Doing Business. As a Common Business Identifier, PAN 2.0 offers a single identity across tax, finance, UPI, GST, and regulatory systems. Eliminating duplication and making compliance easier for individuals and businesses alike.

With these features, PAN 2.0 isn’t just a digital refresh—it is a leap toward unified compliance, faster onboarding, and trusted governance. As India’s Common Business Identifier, it unlocks interoperability between platforms, reduces manual dependencies, and empowers institutions to serve with confidence.

Aadhaar integration is the next chapter. PAN and Aadhaar now work in tandem as the twin pillars driving India’s digital identity transformation. The linkage enables secure, inclusive, and future-ready digital services.

PAN Aadhaar Linking & What It Means for Taxpayers

Linking PAN with Aadhaar remains mandatory even under the PAN 2.0 system. While the new platform simplifies the process, taxpayers must still ensure this linkage to stay compliant and avoid penalties or service restrictions.

The unified portal introduced under PAN 2.0 enables Aadhaar-based e-KYC, eliminating the need for physical documents or manual intervention. The integration ensures faster validation, more secure identity mapping, and smoother updates for existing PAN holders.

Here’s what taxpayers need to know:

- PAN Aadhaar linking is required to avoid deactivation or limitations on financial transactions

- The process will be fully paperless under PAN 2.0 using Aadhaar authentication

- Late linking may invite a fine or restricted access to income tax services

- Aadhaar validation helps maintain accurate demographic and biometric details.

For detailed steps and eligibility, refer to the official Protean PAN 2.0 FAQs.

Aadhaar integration is just one part of India’s broader fintech journey. In the next section, we explore how PAN 2.0 supports digital growth, economic inclusion, and UPI-enabled transformation.

PAN 2.0 in India’s Digital Economy Vision

India’s digital economy is expanding rapidly, powered by real-time payment systems, account aggregation, and e-governance tools. PAN 2.0 stands as a foundational layer in this transformation.

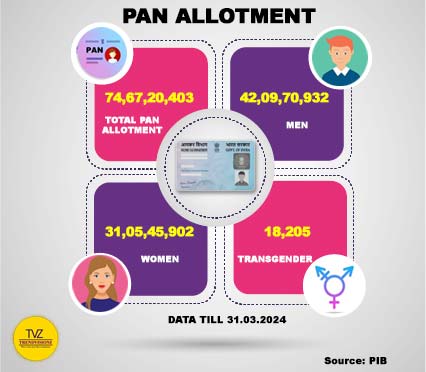

The scale of India’s taxpayer base—over 78 crore PANs and nearly 73 lakh TANs. This makes this digital unification critical for long-term efficiency and inclusive governance.

It bridges the gap between identity verification and digital financial services, enabling smoother transactions, simplified compliance, and increased transparency across platforms.

Here’s how PAN 2.0 empowers India’s digital ecosystem:

- Single digital interface: Offers a unified portal for Aadhaar-linked, paperless PAN application, validation, and correction.

- Real-time verification: Includes dynamic QR codes to instantly authenticate PAN details during financial transactions.

- Common Business Identifier: Acts as a universal ID across GST, banking, fintech, and regulatory systems.

- Stronger UPI compliance: Complements UPI digital payments by improving KYC security and linking PAN to verified users.

- Faster onboarding: Enables seamless digital KYC, reducing time and effort for institutions and users alike.

- Fraud prevention: Links PAN to verified Aadhaar data, minimizing duplication and identity misuse.

- Improved transparency: Enhances visibility in credit history, tax filings, and transaction tracking.

- Support for innovation: Encourages fintech growth by integrating PAN with platforms like digital lending and e-invoicing.

By integrating identity and compliance in a digital-first environment, PAN 2.0 supports India’s broader goals of inclusion, innovation, and institutional trust. As Santosh Agarwal, CEO of PaisaBazaar, puts it,

“A key driver that’s helping build a conducive environment for the long-term and more inclusive growth is India’s digital public assets, powered by credit bureaus, Aadhaar, GST, and the Account Aggregator framework.”

As we explored in our previous article on how UPI payment India are transforming India’s digital ecosystem, PAN 2.0 will surely strengthen this foundation by adding secure, verifiable identity to every transaction.

How to Apply for PAN Card 2.0 (Step by Step)

With PAN 2.0, the application process is now fully digital, faster, and easier to navigate. Whether you’re a first-time applicant or need to update your Permanent Account Number details, the unified portal simplifies every step. No paperwork, no confusion—just a streamlined online experience.

What Existing PAN Holders Need to Know

- No action is needed if you already have a valid PAN

- Upgrading to an e-PAN is optional and free of charge

- Physical PAN cards are still available for a nominal fee

- Applicants can request a physical PAN card by paying a small fee

- Aadhaar linking remains mandatory to keep your PAN active

Step-by-Step Application Process for New Users

Applying for a PAN under the new digital system is quick and paperless. With Aadhaar integration and e-KYC, users can complete the process online without needing to visit any physical office.

- Visit the official designated site: Protean eGov / UTIITSL Website PAN Service

- Select “New PAN Application” and choose Individual or Entity type

- Enter Aadhaar details for e-KYC and OTP verification

- Upload photo and digital signature, if required

- Review all details and submit the form

- Receive your Free e-PAN card on your registered email within minutes

- For physical PAN card, opt-in during application and pay applicable fee

The digital process ensures wider access and quicker turnaround. PAN 2.0 makes owning a Permanent Account Number simpler than ever—while keeping identity verification secure and Aadhaar-linked

Also Read:

- Every Layer Counts: Future-Proofing with Multi-Layer Insulation Technology

- How to use Instagram for Affiliate Marketing

FAQ: PAN 2.0

With PAN 2.0 do we need to change PAN card?

No, you don’t need to replace your existing PAN. But reapply if you want an e-PAN or updated card. PAN 2.0 only changes how new PANs are processed and delivered.

Will PAN 2.0 work as an official business proof document?

Yes, PAN 2.0 now serves as a Common Business Identifier. It is valid proof for banking, GST registration, compliance, and other regulatory processes involving business identity verification.

What is the cost of getting a physical PAN 2.0 card?

While the e-PAN is free, opting for a physical PAN 2.0 card may involve a nominal fee, typically around ₹50 for delivery within India. The exact cost will be displayed during the application process.

A Digital Identity Milestone for India

PAN 2.0 marks a transformative shift in how India manages taxpayer identity. For individuals, businesses, and institutions, it offers faster services, stronger compliance, and a more transparent financial ecosystem. This upgrade brings India closer to a paperless, secure, and unified digital economy.

With Aadhaar integration, e-KYC, and real-time verification, PAN 2.0 sets the stage for global best practices in identity management. As India strengthens its digital infrastructure, TrendVisionz remains committed to decoding such milestones.

Stay tuned with us for expert insights that simplify change and help you navigate the evolving world of fintech and digital governance.

Share your Review

Ready to supercharge your Career journey?

Let’s Grow Together

🔗 Connect with me on BizTech Chronicle to embark on this transformative quest! 🌐

Co-Founder: Trendvisionz – A Premier Digital Marketing Agency in India

🌐📈Navigating Tomorrow’s Tech Frontiers 🚀

Believe, transform, and succeed. Dive into insights, innovation, and industry trends that shape the digital landscape.

💼 Stay ahead in the fast-paced world of business technology. 💡📊

Bonus: Subscribe our Growing 1.95 Lakh+ YouTube Family

Subscribe for the Latest Tech Trends BizTechChronicle.

Join my LinkedIn Group: Digital Marketing, Content Creation World Group

Stay Informed. Connect with Trendvisionz Today! 💼🌐

✍️ A Note from the Editor

At TrendVisionz, we craft each article with purpose—guided by research, passion, and the belief that storytelling can spark change. We’ve kept our content open and free for all, because we believe knowledge should never be behind a paywall.

But creating quality digital content takes time, heart, and resources. If this article resonated with you, we’d be deeply grateful for your support. Even $10/month can help us keep producing content that informs, empowers, and uplifts.

💛 Support our work: You can contribute directly via PayPal or email us at anujmahajan@trendvisionz.com to set up your monthly support.

Thank you for believing in independent digital journalism. —Editor

1 comment

Can I visit the property this weekend?

Comments are closed.