Welcome to the journey of financial empowerment! Building Financial Wealth is not just a goal; it’s a life-changing endeavour. We often hear about the importance of having money saved up for a rainy day, but the true power of wealth-building extends far beyond that. Do the questions “How to be rich?” and “What is financial future?” captivate your curiosity? They prompt contemplation on wealth strategies and long-term financial planning.

As a 20-year-old, I’ve learned that starting early is the secret to building substantial wealth. Embracing the power of compounding and taking calculated risks, I’ve begun my journey toward financial security. The lessons learned from successful investors like Warren Buffett inspire me to stay committed for the long term.

If you don’t find a way to make money while you sleep, you will work until you die

Warren Buffett

Also Read:

- India’s EV Evolution: Seize the Moment with Profitable Business Models

- What About True Love: Shield Against Relationship Disconnect

- How to Spot Fake Videos: Identifying Deepfakes

Why Building Wealth Really Matters?

Wealth building is the process of accumulating assets, increasing your net worth, and securing your financial future. It’s not just about being rich; it’s about achieving financial security and freedom. Initiate financial growth with beginner passive income. Your financial future is the outcome of intentional choices and strategic planning. Embark on the journey to financial security through cultivating multiple sources of income. Explore diverse avenues, from investments to side projects, and enhance your economic resilience for a robust and prosperous future.

Explore how to build wealth, while you learn, paving the way for financial freedom. Here’s why wealth creation matters:

- Peace of Mind – Imagine having a financial safety net when life throws unexpected challenges your way—a medical emergency, job loss, or an unforeseen opportunity. This financial stability brings peace of mind, much like the calm after a storm.

- Opportunities Abound – Wealth creation opens doors to opportunities you might not have thought possible. Just as Napoleon Hill emphasized in his book “Think and Grow Rich,” it’s about turning dreams into reality. Wealth can fund your dream business, enable world travel, or let you pursue your passions.

- Retirement Security – A comfortable retirement is a shared aspiration. Wealth building ensures you can retire on your terms, with the lifestyle you desire. Consider Warren Buffett’s journey, documented in “The Snowball ” by Alice Schroeder, as an inspiring example of long-term wealth building.

Also Read: ‘Bambai Meri Jaan’ Web Series 2023 Review: Corruption, Crime, Family

Setting Clear Financial Goals: A Path to Building Financial Wealth

Setting specific financial goals is the cornerstone of financial freedom. It’s like plotting a course on a map – without clear destinations, you may wander. Stay informed with the latest news about money, gaining valuable insights into financial trends, market developments, and opportunities for smart financial decision-making. Here’s why setting clear financial goals matters and how it’s linked to wealth building.

The Significance of Specific Goals

Specific financial goals provide clarity and purpose to your wealth-building journey. Whether it’s saving for a down payment on a home, funding your children’s education, or retiring, having clear objectives gives you direction and motivation.

Tying Goals to Building Financial Wealth

Every goal, be it short-term or long-term, plays a role in your wealth creation strategy. Consider this case study: A young professional sets a plan to save a certain percentage of his income each year. Over time, these savings can be invested, growing and contributing to their financial wealth.

Furthermore, setting specific targets allows you to measure progress and adjust your financial strategies. It’s akin to tracking your journey on that map, ensuring you stay on the right path towards building financial wealth.

The Power of Budgeting and Saving: Keys to Wealth Accumulation

Budgeting and saving are essential pillars of wealth accumulation, offering structure and financial discipline.

Role of Budgeting and Saving: Budgeting serves as your financial GPS, helping you divide income and track expenses. Saving involves setting aside funds for future needs, whether it’s emergencies or investments.

Practical Tips for Effective Budgeting and Saving:

- Create a Realistic Budget: Assess income and allocate funds for necessities, savings, and investments.

- Automate Savings: Set up automatic transfers to savings or investment accounts for consistent protection.

- Emergency Fund: Build a safety net with at least three to six months’ living expenses.

- Track Expenses: Use budgeting apps or spreadsheets to track spending and identify areas for saving.

- Focus on Debt Reduction: Focus on paying off high-interest debts to free up funds.

- Invest Your Savings: Put your savings to work by investing in assets like stocks, bonds, or mutual funds.

Budgeting and saving lay the foundation for wealth creation, ensuring you live within your means and grow your wealth over time.

Investment Strategies for Wealth Building: A Roadmap to Financial Prosperity

Building financial wealth requires a comprehensive approach, and savvy investment strategies are at the core of your journey towards prosperity.

1. Diversify Your Income Streams:

Don’t rely on your primary job. Explore additional income sources such as freelancing, investments, or side businesses to increase your financial resilience.

2. Make a Budget:

Creating a budget is the first step towards financial control. It guides your spending, ensures you save consistently, and helps you align your financial actions with your goals.

3. Prepare an Emergency Fund:

Life is full of surprises, and an emergency fund acts as your financial safety net. Three to six months’ worth of living expenses can provide peace of mind during unexpected times.

4. Investing: Start with Small SIPs:

Start your investment journey with Systematic Investment Plans (SIPs) in mutual funds. Even small, regular contributions can grow over time due to the power of compounding.

5. Stop Reckless Spending:

Identify and eliminate unnecessary expenses. Transfer those funds to savings and investments. This simple shift in your financial habits can pave the way to a more secure future.

6. Try to Avoid Debt:

Prioritize paying off high-interest debts. Being debt-free frees up more funds for investments and reduces financial stress.

7. Set aside money for future needs:

Whether you want to buy a car, upgrade your phone, or buy a house, or go shopping, planning and saving will keep you from taking money from your investments.

8. Set Financial Goals for Family:

Include your family in your financial planning. Establish goals for significant life events, like marriage or education, and work towards them together.

9. Take Insurance, Especially Health and Life:

Insurance safeguards your financial well-being. Moreover, health and life insurance policies provide essential protection during emergencies and guarantee the long-term security of your loved ones.

10. Increase Your Financial Literacy:

Expand your financial knowledge. Understand different investment avenues, risk management, and market trends. A well-informed investor makes better financial decisions.

Incorporating these strategies into your financial plan can boost your wealth-building efforts. Remember, building financial wealth is a marathon, not a sprint. Stay disciplined, remain adaptable, and watch your wealth grow over time.

Diversification and Risk Management: Safeguarding Your Investments

Diversification and risk management are cornerstones of successful wealth building through investments.

The Importance of Diversification: Diversification involves spreading your investments across different asset classes. This strategy is essential because it:

- Reduces risk: Having a wide range of assets makes it less likely that a few bad decisions will ruin your whole portfolio.

- Offers the chance to make money: Diverse investments try to balance the risk of losing money in one area with the opportunity of making money in another.

- Smooth out volatility: Diversification gives you stability when the market goes up and down, which makes it easier to stay invested in the long run.

Insights into Managing Risk:

Effective risk management is crucial for investment success, including:

- Asset Allocation: Determine the right mix of assets based on your goals and risk tolerance.

- Regular Review: Track and adjust your portfolio to maintain your desired balance.

- Diversify: Expand diversification by investing in international markets.

- Risk Assessment: Understand the specific risks associated with each investment.

By combining diversification with prudent risk management, you can construct an investment portfolio resilient to market challenges. While it doesn’t eliminate risk entirely, it significantly reduces the likelihood of jeopardizing your financial future.

ALSO READ : Empowering India’s Digital Realm: Are You Cyber Vigilant?

The Long-Term Wealth-Building Mindset: Your Path to being Wealthier

For long-term wealth building, you need more than financial strategies. It would be best if you also had an attitude of discipline and commitment.

The Wealth-Building Mindset

- Patience and Persistence: Understand that building wealth takes time. Stay committed to your financial goals even when facing obstacles or setbacks.

- Delayed Gratification: Be willing to forgo short-term pleasures for long-term financial security. It’s about making choices that benefit your future self.

- Continuous Learning: Stay informed about financial markets and investment opportunities. The willingness to adapt and learn is key to making informed decisions.

- Emotional Resilience: Emotional control is vital. Avoid impulsive decisions based on market volatility or fear.

Success Stories and Motivation

Let’s draw inspiration from individuals who’ve embraced this mindset and achieved remarkable financial success:

- Warren Buffett, the famous businessman and owner of Berkshire Hathaway, is a great example of how to build wealth. He invested his money into long-lasting companies like Coca-Cola and got through the 2008 financial crisis by staying calm and taking advantage of opportunities when other people were panicking.

- His story shows how anyone can be successful if they are patient and use long-term financial plans. By copying Buffett’s dedication to smart investments and long-term trust, you can also set yourself up for financial success.

Embracing a long-term wealth-building mindset sets the stage for financial success. It’s about staying the course, adapting to change, and envisioning a future of financial abundance.

Tax Efficiency and Wealth Preservation: Keys to Financial Success

Tax efficiency plays a vital role in preserving and growing your wealth. By employing smart tax planning strategies, you can safeguard your financial success.

Tax Planning Strategies:

1. Invest in ELSS: Consider Equity-Linked Saving Schemes (ELSS) for tax-saving and potential high returns. ELSS investments are eligible for tax deductions as per the provisions outlined in Section 80C of the Income Tax Act.

2. Utilize HRA Benefits: If you’re a salaried individual, maximize House Rent Allowance (HRA) benefits by providing rent receipts. This can significantly reduce your taxable income.

3. Explore NPS: The National Pension System (NPS) offers tax deductions under Section 80CCD(1B). It’s a smart way to save for retirement while lowering your tax liability.

4. Donation Deductions: Donations to registered charities can lead to deductions under Section 80G. Support a cause you believe in while reducing your tax burden.

Wealth Preservation Through Tax Efficiency: A Lesson from Rich Dad Poor Dad

In “Rich Dad Poor Dad,” the importance of tax strategies is clear: the rich save taxes while the poor often pay more than necessary. Smart tax management not only keeps more of what you earn but also provides stability and enables you to leave a more substantial legacy.

By adopting tax-efficient practices inspired by “Rich Dad,” you can secure your wealth and pave the way for future generations.

Professional Guidance and Financial Advisors: Your Path to Building Financial Wealth

In the complex landscape of personal finance, the guidance of financial experts is a crucial asset. Here’s why tapping into their knowledge can be transformative for both you and your family:

- Expertise in depth: Financial experts like (CA’s) know a lot about financial rules, taxes, and business strategies. Their advice is very helpful when dealing with complicated economic issues.

- Customized Solutions: They can craft financial plans tailored to your goals and your family’s requirements, ensuring a personalized and effective strategy.

- Risk Mitigation: Because they are experts at assessing risks, they can help protect your family’s financial future by finding and taking care of possible threats.

- Tax Optimization: CA’s are experts at tax planning, which means they can help you legally reduce your tax loads and free up money for your family’s health.

- Financial security: Working closely with them enables you to create a comprehensive financial plan, ensuring your family’s long-term safety and prosperity.

- Peace of mind: Seeking assistance from an expert provides peace of mind, as you entrust your family’s finances to capable hands.

Hiring financial experts can change your life by giving you the knowledge and tactics you need to protect your family’s financial future.

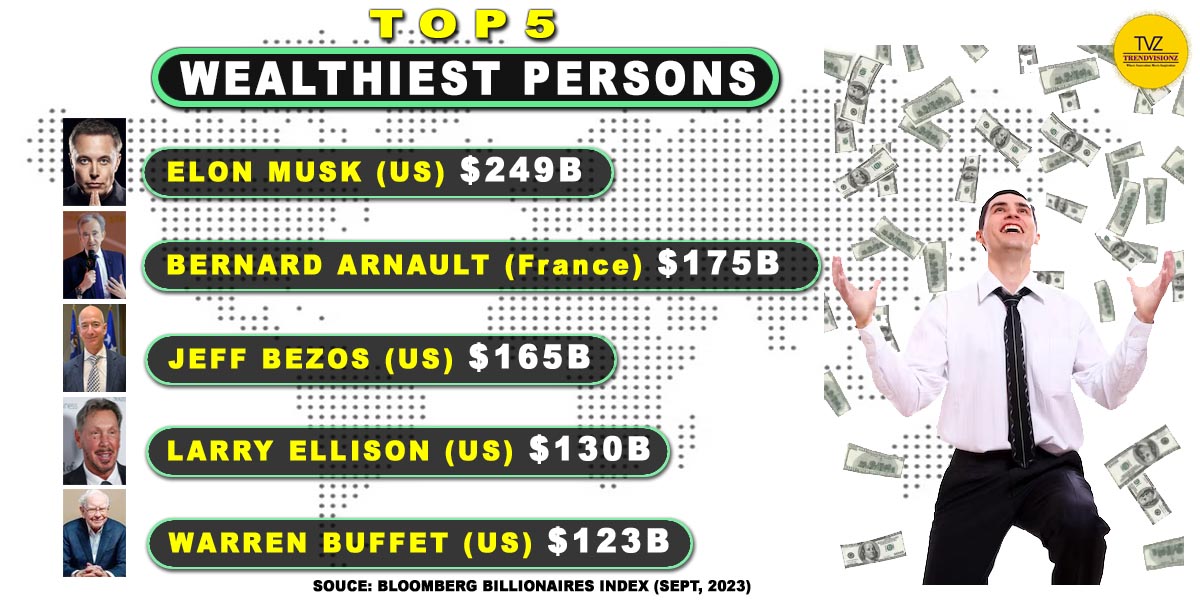

Facts to Know About : Top 5 Wealthiest People in the World

Meet the titans of wealth, the visionaries who have scaled the summit of financial prosperity. In this, we delve into the top 5 wealthiest individuals globally, each a maestro of strategic decisions and visionary leadership.

- Elon Musk : Founder of Tesla and SpaceX, Elon Musk’s strategic vision and investments have propelled him to the top of the wealth ladder. His role in pioneering electric vehicles and space exploration is reshaping industries.

- Bernard Arnault : As the CEO of LVMH, Bernard Arnault oversees a luxury empire that includes Louis Vuitton, Moët & Chandon, and more. He exhibits intelligent leadership in the world of fashion and luxury goods

- Jeff Bezos : The founder of Amazon, transformed e-commerce and cloud computing. His business acumen and Amazon’s global success have made him one of the wealthiest individuals globally.

- Larry Ellison : The co-founder of Oracle, played a pivotal role in the tech industry’s evolution. His leadership in the fields of database software and cloud computing has been instrumental

- Warren Buffett : The legendary investor and owner of Berkshire Hathaway, is known for his disciplined investment approach. His financial wisdom and strategic investments have been instrumental in accumulating immense wealth.

Embark on a cosmic journey as we reveal the zodiac signs most likely to be billionaires status. Their financial freedom journeys inspire us to navigate the path to building financial wealth with intelligence and strategic foresight. Many individuals seek multiple source of income with the aim of achieving financial freedom.

Also Read : How Global Food Chains are Enhancing Local Flavours

Conclusion

In this exploration of building financial wealth and achieving financial prosperity, we’ve gathered insights from financial experts, success stories, and the world’s wealthiest individuals. Understanding “What is financial future” is crucial; it represents the result of deliberate planning, strategic decisions, and a commitment to a secure and prosperous tomorrow. Diversifying your income through multiple streams of income is a vital step toward building wealth and attaining financial freedom.

Commencing your journey to building wealth requires acknowledging it as an achievable goal, grounded in well-informed choices. Both the affluent and experts concur: dedication, strategic planning. Wealth Creation and the right mindset are indispensable. Take decisive action, apply these proven strategies, and embark on your building wealth journey today.

Let’s Grow Together

🔗 Connect with me on BizTech Chronicle to embark on this transformative quest! 🌐

Co-Founder: Trendvisionz – A Premier Digital Marketing Agency in India

🌐📈Navigating Tomorrow’s Tech Frontiers 🚀

Believe, transform, and succeed. Dive into insights, innovation, and industry trends that shape the digital landscape.

💼 Stay ahead in the fast-paced world of business technology. 💡📊

Bonus: Subscribe our Growing 1.95 Lakh+ YouTube Family

Subscribe for the Latest Tech Trends BizTechChronicle.

Join my LinkedIn Group: Digital Marketing, Content Creation World Group

Stay Informed. Connect with Trendvisionz Today! 💼🌐